Image source: The Motley Fool.

Interxion Holding N.V (NYSE:INXN)Q4 2018 Earnings Conference CallMarch 06, 2019, 8:30 a.m. ET

Contents: Prepared Remarks Questions and Answers Call Participants Prepared Remarks:

Operator

Ladies and gentlemen, thank you for standing by, and welcome to the Q4 2018 Earnings Webcast. At this time, all audio participants are in a listen-only mode. During the presentation, we will have a question-and-answer session. (Operator Instructions). I must advise the webcast is being recorded today, Wednesday, the 6th of March 2019.

I'm going to pass the webcast over to your first speaker today, Jim Huseby. Please go ahead.

Jim Huseby -- Investor Relations

Thank you, Callum. Hello everybody, and welcome to InterXion's fourth quarter and year-end 2018 earnings conference call. Today, I'm joined by David Ruberg, InterXion's Vice Chairman and CEO; John Doherty, the Company's Chief Financial Officer; and Giuliano Di Vitantonio, our Chief Marketing and Strategy Officer. To accompany our prepared remarks, we prepared a slide deck, which is available on the Investor Relations page of our website at investors.interxion.com.

Before we get started, I'd like to remind everyone that some of the statements that we will be making today are forward-looking in nature and involves risks and uncertainties. Actual results may vary significantly from those statements and may be affected by the risks we identified in today's press release and those identified in our filings with the SEC. We make no obligation, and do not intend to update or comment on forward-looking statements made on this call.

In addition, we will provide non-IFRS measures on today's conference call. We provide a reconciliation of those measures to the most directly comparable IFRS measures in today's press release, which is posted on our Investor Relations page at investors.interxion.com. We'd also like to remind you that we post important information about InterXion on our website at interxion.com, and on social media sites such as LinkedIn and Twitter.

Following our prepared remarks, we will be taking questions. And now I'm pleased to hand the call over to InterXion's CEO, David Ruberg. David?

David Ruberg -- Chief Executive Officer

Thank you, Jim, and welcome to our fourth quarter and year-end 2018 earnings call. During the fourth quarter, InterXion again delivered solid growth, reflecting a combination of favorable European demand trends, consistent execution, and a sustained high level of data center expansion across our footprint to meet the requirements of our customers.

The cloud and content platforms remain active, in terms of expanding their colocation capacity for core and edge notes, not only the Big 4 markets, but increasingly in other key European markets as well. These customers understand InterXion's value proposition and are seeking to leverage the dense connectivity available in our data center campuses.

All of this is taking place against the backdrop of global digital transformation. The real value comes not just from the conversion to digital, but particularly the move to connected digital. The way in which we live, work and communicate with our families, friends and business contacts is fundamentally changing. How we produce and consume content, manufacture products, take care of our health or drive somewhere are evolving at a dramatic pace. This is all happening in real time. The combination of our highly connected data centers, our breadth of coverage and our strategic approach, which is focused on the longer-term, means that we remain extremely well positioned to capture the demand for colocation capacity now and over the coming years.

Please turn the Slide 4. Turning to the highlights of our full year 2018 results. InterXion posted 15% year-over-year growth in both recurring and total revenue, while adjusted EBITDA increased by 17%, representing year-over-year EBITDA margin expansion of 70 basis points to 45.9%. We invested over EUR450 million of capital expenditure in the business.

During the year, we opened two new data centers and expanded capacity in 9 of our 11 countries, with the remaining two countries scheduled to open new capacity in the first half of 2019. Against the backdrop of high demand-driven expansion, we maintained a steady utilization rate of 79%, reflecting our discipline in matching new capacity to the demand that we're experiencing and we continue to grow our land bank for future expansion with land acquired in four markets during the year.

Please turn to Slide 5. Now turning to the highlights of our fourth quarter results. InterXion posted 13% year-over-year growth in both recurring and total revenue in Q4. Adjusted EBITDA increased by 15%, representing year-over-year margin expansion of 60 basis points. We invested over EUR130 million in capital expenditure, opening data center expansions in three countries. Two new data center builds were announced in the quarter, which are in Frankfurt and Marseille. Bookings of quarter remained strong, while the sales pipeline continues to reflect solid demand, and pricing remains stable and churn continues to be low and within our historical ranges.

Please turn to Slide 6. Looking at the Q4 financials in a little more detail. Revenue in Q4 came in at EUR147 million, up 13% from last year and up 3% sequentially. Recurring revenue at nearly EUR140 million, represented 95% of total revenue, was also up 13% compared to last year. And adjusted EBITDA was just below EUR68 million, an increase of 15% year-over-year and 3% sequentially, equating to an adjusted EBITDA margin of 46.1%. And John will talk in more detail about these numbers later in the call.

Please turn to Slide 7. We added 4,500 square meters of equipped space in the fourth quarter, bringing the total increase for the year to 22,300 square meters. We ended 2018 with 144,800 square meters of equipped space. We had a 3,800 square meters of revenue generating space in the quarter, with significant installations in Germany, Frankfurt and the Netherlands. For the full year 2018, the increase was 15,200 revenue generating square meters, keeping pace with a quick capacity such that utilization at the end of the year remain fairly steady at 79%.

Recurring cross connect revenue continue to grow faster than recurring revenue on a year-over-year basis and contributed 6% of total revenue in the fourth quarter. We had noticed the customers have started the transition from 10 gig cross connects to 100 gig cross connects, which we expect will unfold over a number of years as new technologies are rolled out to carry data traffic that is expected to grow almost five-fold over the next five years.

Please turn to Slide 8. During the fourth quarter, new capacity was opened in three of our four Big 4 markets, specifically Amsterdam, Paris and Frankfurt, followed by the opening of our third data center in London, early in the first quarter. Since the end of the third quarter, we've also announced three new data center builds, which are Marseille 3, Frankfurt 15 and today Zurich 2. Additionally, we are announcing that we're equipping a further 2,600 square meters in Frankfurt 15.

Including this expansion, we've announced additions to our equipped space capacity of over 28% through to the end of 2020. Of this new capacity, over 70% is scheduled to open between mid-2019 and the end of next year. We have newbuilds under way at 9 out of the 11 countries in which we operate. We also added to our land bank in Copenhagen and Zurich in the fourth quarter.

Please turn to Slide 9. In Q4, we continue to see the same bookings and revenue trends that we saw in previous quarters. While all segments are growing, the growth from platforms is faster than the growth from enterprise and connectivity. As a result, we now have 38% of our revenue coming from platforms and the remaining 62% almost equally split between connectivity and enterprise. We expect this trend to persist in the coming quarters as the strong backlog and bookings from platforms converts into revenue. With more platforms joining our connected communities and expanding across multiple locations, we are seeing a more widespread distribution of revenue across this segment, with five cloud providers and two content providers in our top 20 customers by revenue. The remainder of the list includes nine connectivity providers and four enterprises.

The value that we get from the platforms goes beyond the top line contribution fueled by compute nodes. These customers continue to deploy network nodes that add tremendous value to our connected community and they're doing across new countries and new locations. For instance, Google recently added a Google Cloud Interconnection PoP in Zurich, a location where the demand for cloud is growing rapidly. This follows similar deployments by them in Stockholm, Madrid and Marseille over the last two quarters. These deployments demonstrate the demand for private connections to access public clouds in a secure and reliable manner. It is steadily growing across Europe. Since August of 2018, we have seen 10 new on-ramps installed in our data centers by major cloud providers.

In the connectivity sector, Q4 was a particularly strong quarter capping a year of solid growth across all of our cities, but especially Marseille, Frankfurt and Madrid. While connectivity is the most mature segment, high growth in the volume of traffic generated by cloud and content providers is a catalyst for connectivity providers to expand capacity in our facilities and to deploy increased numbers of cross connects.

In the enterprise segment, we're in the early innings of a market transition which is starting to attract a new breed of customers to colocations. These are enterprises that in the past would have typically run their IT in their own data center or in an outsourced environment. They are now in the early stages of the digital transformations and require more connected and hybrid IT architecture. These customers typically start with a small deployment and private multi-cloud connections, and then expand as their requirements grow. Overtime, we will see larger deployments for enterprises engaging in more fundamental rearchitected their IT infrastructure.

European enterprises such as Carlsberg, one of leading brewery groups in the world are examples of customers and companies at the forefront of a wave of digital transformation. These companies have chosen to deploy significant elements of their IT infrastructure at InterXion. They appreciate the significant value at a colocation environment offers to a digital enterprise architecture. The benefits include low latency access to multiple clouds and superior edge network performance to enhance their customers experience, while retaining security and flexibility. This transportation -- this transformation opportunity is just emerging as expected to gain momentum in the coming years.

With that, I would now like to turn the call over to John.

John Doherty -- Chief Financial Officer

Thanks, David. It's a pleasure to participate on the call today. I've enjoyed the opportunity to reconnect and meet with many of our investors and analysts since I joined InterXion in November. After four months at the Company, I'm more excited than ever about the opportunities ahead of us.

Please turn to Slide 11. As David highlighted, InterXion delivered another solid quarter and total revenue growth of 13% compared to the prior year and 3% higher sequentially. Currency movements were not significant in the quarter. As a result, constant currency growth rates, both year-over-year and sequentially were consistent with reported growth rates. Recurring revenue in the fourth quarter was EUR139.7 million, also representing a 13% year-over-year increase and a 4% sequential increase.

Recurring ARPU was EUR412 per month in the quarter, consistent with our expectations and down EUR1 from third quarter due to the dilutive impact of new installations largely occurring late in the quarter. Notably, ARPU increased slightly year-over-year, despite a large volume of new customer installations during the year. Recurring revenue remained at 95% of total revenue in the quarter. Non-recurring revenue in Q4 was EUR7.2 million, up 12% year-over-year and down 3% sequentially.

Cost of sales was EUR57.2 million in the quarter, up 17% year-over-year and up 2% sequentially, resulting in gross profit of EUR89.7 million, and a 11% increase year-over-year and 4% sequentially. The gross profit margin for the quarter was 61.1%, down from 62.4% a year ago. As we discussed last year, the Q4 2017 results included a number of one-time items that positively impacted our gross profit margin. The largest was a usage space energy credit in Germany, for which the full annual impact was recognized in the Q4 '17 numbers. Normalized for these one-time items, the year-over-year reduction in our gross profit margin was a more modest 40 basis points, primarily due to the expansion drag associated with bringing on new capacity.

Sales and marketing expenses were EUR9.5 million in the fourth quarter, up 5% year-over-year and up 9% from the third quarter, with a sequential increase reflecting seasonality of marketing activity. Fourth quarter sales and marketing costs were 6.4% of total revenue, consistent with the 6% to 7% range that we have seen throughout 2018. Other G&A costs were EUR12.5 million in the quarter, down 3% year-over-year and up 6% sequentially. At 8.5% of revenue, other G&A costs remained within our expected range of 8% to 9% of revenue.

Adjusted EBITDA at EUR67.7 million increased 15% year-over-year and was up 3% sequentially, resulting in an adjusted EBITDA margin of 46.1%. This represented a year-over-year increase of 60 basis points and a 20 basis point sequential reduction.

Fouth quarter depreciation and amortization expense came in at EUR34.3 million, an 8% -- excuse me, an 18% increase year-over-year and up 4% sequentially, and continues to be consistent with our growing depreciable asset base. The finance expense in the fourth quarter was EUR15.8 million, 28% higher than in Q4 '17 and 34% higher than the prior quarter. This increase was primarily a function of higher principal amounts following the 2018 refinancing and bond tap.

Income taxes in the fourth quarter were EUR7.3 million, an increase of EUR2.8 million from Q3, equating to an effective tax rate of 48%. This increase is largely due to the impact of reductions in local corporate tax rates on our deferred tax positions, particularly in the Netherlands. Excluding this and other non-deductible expenses such as share-based payments, the normal effective tax rate is 26%.

Our LTM cash tax rate at 34.6% continues to reflect the impact of the Q2 refinancing. Net income was EUR8 million in Q4, down 18% year-over-year and 20% sequentially, due to the higher finance and tax expenses. These factors also impacted adjusted net income in the quarter, which came in at EUR7.8 million, down 26% year-over-year and down 33% sequentially. EPS and adjusted earnings per share were each at EUR0.11 on a diluted share count of 72.2 million shares.

Please turn to Slide 12. Strength in InterXion's Big 4 markets continued in the fourth quarter, led once again by Germany and France. Revenue was EUR97.3 million, up 14% year-over-year and 4% sequentially on both reported and constant currency basis. Adjusted EBITDA in the Big 4 was EUR52.6 million in the quarter, a year-over-year increase of 9% and a sequential increase of 1%, with continued strong margins of 54%.

Our Rest of Europe segment also delivered double-digit growth, with fourth quarter revenue of EUR49.6 million, up 12% year-over-year and up 2% sequentially on both reported and constant currency basis, led by Austria, Denmark and Sweden. Adjusted EBITDA in the Rest of Europe segment was EUR30.2 million, up 16% year-over-year and 5% sequentially, with an adjusted EBITDA margin of 60.9%, an increase of 190 basis points from the third quarter.

Please turn to Slide 13. Turning briefly to a review of the full year 2018 results. Total revenue was EUR561.8 million, up 15% year-on-year. Foreign exchange had no material impact on our full year results. Recurring revenue was EUR533.1 million, up 15% over 2017. Cost of sales was EUR219.5 million, up 15% year-over-year. Gross profit was EUR342.3 million, also up 15%, while gross margins were a modest 20 basis point decline to 60.9%. Sales and marketing costs were EUR36.5 million, up 9% year-over-year, while other G&A costs were EUR48 million, up 8% versus 2017. This resulted in solid operating leverage at the adjusted EBITDA line with growth of 17% and margins expanded by 70 basis points despite the slight decline in gross profit margin.

Looking ahead into 2019, we expect ARPU to remain within a range of EUR411 and EUR415, based on the timing of new customer installations, as continued growth in the base is offset by the dilutive impact of new installations. Cross connect revenue is expected to be approximately 6% of total revenue for the year. Non-recurring revenue should remain at approximately 5% of total revenue. Sales and marketing costs are expected to remain within the 6% to 7% range that occurred in 2018, while other G&A costs are likely to rise toward 10% of revenue in the first quarter due to normal seasonality before settling down at near 9% of total revenue for the remainder of 2019. In light of growing energy costs and continued expansion drag from new capacity openings, adjusted EBITDA margin is expected to remain steady in 2019.

Please turn to Slide 14. From the beginning of 2019, we have adopted IFRS 16. I will not spend much time on this during the call as most of you will be familiar with the primary impacts of this new lease accounting standard given its similarity to changes happening in US GAAP. In practical terms, IFRS 16 means that operating leases will be brought on to the balance sheet and treated in the same way as we treat finance leases. The end result is a reduction in rent expense and an increase in interest expense and depreciation charges from the capitalized lease (ph), but there is no cash impact.

Compared with 2018, IFRS 16 is expected to have the following impact on our key financial metrics as set out on the slide. Total revenue and recurring revenue will see a negligible impact from IFRS 16. Adjusted EBITDA margin in 2018 would have benefited by approximately 600 basis points, and gross leverage adjusted for full year 2018 on the same basis will increase slightly under one turn as future lease payments will be recognized as liabilities. This adjustment is not expected to have any impact on our credit ratings, and IFRS 16 does not form part of our financial covenant reporting.

Throughout 2019, we will provide a quarterly reconciliation of key metrics between the reported results on an IFRS 16 basis and the previous basis. Overall, it should be noted that following the implementation of IFRS 16, our financial results, particularly in terms of adjusted EBITDA margin, will be reported in a way that is more consistent with our US peer group.

Please turn to Slide 15. InterXion remains in expansion mode in response to continued strong demand. During 2018, we invested EUR451 million in capital expenditure, 93% of which was allocated to capacity increases. Over the last three years, that is between 2016 and 2018, InterXion has invested approximately EUR960 million in CapEx and increased equipped capacity by approximately 44,000 square meters, an increase of 43%. During this time, our utilization rates have remained within a tight range close to 80%. A portion of our future CapEx will continue to be deployed on freehold and land acquisitions to meet future expansion requirements, alongside the ongoing cycles of investment in our existing data center portfolio. We remain consistent and highly disciplined with respect to our capital allocation processes and anticipated returns.

Please turn to Slide 16. InterXion ended the year with EUR186.1 million in cash and cash equivalents, with the refinancing and subsequent bond tap being the most significant balance sheet events for the year, giving us greater flexibility with the unsecured status of the notes. Our EUR200 million RCF was undrawn at the year end, giving us nearly EUR400 million in available liquidity. In this quarter, we increased our RCF by a further EUR100 million to provide additional flexibility.

Our credit metrics remain solid with net leverage at 4.3 times and all announced expansion projects through 2019 being fully funded. Cash ROGIC, which is our measure of return on gross invested capital was 10% in 2018 and consistent over the last two years.

Please turn to Slide 17. At the end of 2018, a group of 37 fully built-out data centers contain 91,800 square meters of equipped space. This group is 82% utilized and continue to generate strong and stable cash returns of 23% over the last 12 months with gross margin of 66%. The revenue and returns of a single data center will typically grow for a number of years after the site is essentially full from a space perspective. The combination of annual escalators, customers increasing their energy consumption and the growing contribution from cross connects are the drivers of the 5% LTM recurring revenue growth scene for this group of data centers.

As we have done in prior years, we will reset the basis for this chart on our first quarter earnings call, as you roll the period forward by a year to include all of our fully built-out data centers as of January 1st 2018.

And with that, I will now turn the call back over to David.

David Ruberg -- Chief Executive Officer

Thank you, John. As we wrap up another successful year for InterXion, I wanted to come back to the strategy that has brought us to where we are today and continues to be the guiding principle for current and future investments. For InterXion, it all starts with our relentless customer focus that has always been at the heart of our culture. By building trusted relationships with our customers, not only we've been able to sustain the growth of our Company, but it has helped us to anticipate future directions and make the appropriate investments to stay well positioned.

A year-ago, we introduced a new framework to understand, manage and serve our customer base, predicated on the realization that there are three games going on simultaneously in the industry. One game for the most mature segment, which is connectivity. Another game for the segment that is approaching the steepest portion of the adoption curve, namely platforms. And one game for the segment that has the largest long-term potential, which is enterprise. Each of these games started at a different point in time and is currently in a different inning. There are also sub games that are unfolding and powerful inter dependencies between these games that we explore during the 2018 earnings calls.

The rapid growth of cloud platform and content platforms creates opportunities for both connectivity and enterprise. That is the heart of the connected communities that we enable. This concept is virtually depicted on this slide, which describes directionally where the industry is headed without the intent to provide accurate predictions on relative size and timing of these opportunities. As we enter 2019, we can look at how these segments have evolved over the past year and how they are contributing to our business.

Connectivity remains the foundation for everything we do, as well as the key barrier to entry for competitors with the real estate orientation. Industry analyst agree that global data traffic is growing rapidly, especially in Europe, which is in turn driving demand for new PoPs from connectivity providers, as well as CDNs. Although these deployments were generally small, they tend to have higher ARPUs while driving adoption of cross connects and cloud connect. This all helps to create stickiness in our communities.

The connectivity segment still represents almost one-third of our revenue and we saw a healthy growth in 2018 on the back of the interplay of platforms and connectivity. With changing data traffic patterns, we have seen European carriers become more prominent in our data centers. This partly reflects the local origin of traffic pushed through the interconnection hubs by cloud and by content providers, which is in contrast to the past when global traffic between carriers was a more prominent feature.

We continue to expect a mid to high single-digit growth for the segment in coming years. We may see the occasional new player into the market, but growth will primarily stem from the covenants in spending into new geographies, deploying new services, adding cross connects and additional PoPs to adjust the explosion in the volume of data traffic.

Platforms, especially clouds dominated demand in 2018, representing over 60% of bookings, a trend that we expect to continue to see over the next two or three years. While we continue to see a high concentration demand within this segment, we are witnessing more evenly distributed demand across the top cloud providers. These market leaders are increasing the size of the deployments and the duration of the contracts, as our long-term demand becomes more predictable. All cloud providers have continued to deploy network nodes in highly connected locations. There is a growing awareness on their part of the value deploying compute capacity in close proximity to these network nodes. This is one of the key factors leading cloud providers to deploy compute nodes with interaction and locations that were originally developed purely as interconnection hubs. These locations have now becoming cloud in content hubs and are evolving into larger connected campuses.

As we develop deeper relationships with the large cloud customers, we increasingly focus on their key requirements which are: including line of sight to long-term capacities, flexibility of data center designs, Pan European coverage, consistent execution across countries, and flawless post sale operations.

Content platforms are driven by different set of requirements, as they're implementing a very distributed network architecture, with subsea cables and edge notes carrying large volumes of traffic. Some of these providers have decided to deploy the compute capacity in the public clouds, especially in the regions outside the US, which provides another driver to the emergence of connected communities in our data center. Both types of these platforms are approaching the steepest part of the S-curve, adoption curve in Europe as the global adoption of cloud and content services continues to unfold and new technologies as virtual reality and AI become mainstream. Our observation remains that different countries are at varying stages of maturity with European roll out typically starting in UK and cascading across Western Europe and into other regions.

Consequently, the platform segment overall has substantial headroom for growth, especially in the countries where cloud adoption is in its infancy. As we entered 2019, this segment represents almost 40% of our revenue, and we expect this proposition a proportion to grow in the next couple of years.

Demand from enterprises continue to evolve in 2018, as they are undergoing a radical transformation of IT architecture, shaped by digital transformation and the migration to the cloud, which leads to the diminishing role of enterprise owned data centers, and an evolution of enterprise network and IT outsourcing. As a result of this transition, the demand for traditional IT outsourcing is now shifting toward demand for co-location as a cloud enabler. We expect that the bulk of the demand will shift from non-carrier dense data centers to locations where the cloud provides -- cloud providers deploy their on-ramps and will take a couple of years for the crossover point to be reached.

From a geographical standpoint, the enterprise segment in Europe is not like in US by as much as it is for platforms, because we have a large number of local enterprises that are starting their cloud journey where they are headquartered. This gives us a competitive advantage, because enterprises tend to pick one vendor and also use local systems integrators. We expect demand from this segment to continue to grow steadily over the next couple of years. To capture this opportunity, we are enhancing our local go-to-market capability focused on Europe to complement our international sales organization that remains focused on global customers.

Each of these three segments, connectivity, platforms and enterprises require a different approach, because of their respective stage in maturity, technical requirements and scale and complexity of the opportunity. Our go-to market model based on customer segments enables us to achieve this goal and to strike a careful balance between strengthening the installed base, capturing the ways of rapid growth and seeding the next wave of demand. At the same time, we continue to actively develop new products and implement operational improvements that meet the evolving requirements of the three segments. This is a balancing act that we've been performing successfully for quite some time and we will continue to provide the -- and will continue to provide the foundation of our future profitable growth.

Please turn to Slide 20. Before getting to specifics of our guidance, I'd again like to remind you about our guidance philosophy. Our approach is to provide annual guidance for revenue, adjusted EBITDA and CapEx on our Q4 call, and then potentially update guidance if appropriate during the year. For 2019, our guidance includes the adoption of IFRS 16, which does has -- does have a material impact on adjusted EBITDA. Therefore, for 2019, we expect total revenue to be in the range of EUR632 million to EUR647 millino. We expect adjusted EBITDA to be in the range of EUR324 million to EUR334 million, and we expect the capital expenditures to be between EUR570 million and EUR600 million.

Before opening up the call to Q&A, I would like again to express my thanks to all of our employees across the Company for their continued commitment and customer focus. The continued success of this Company is a product of their hard work. I would also like to thank our shareholders and bondholders for their continued support.

Now, let me hand the call back to the operator to begin the question-and-answer session.

Questions and Answers:

Operator

Thank you. (Operator Instructions) Our first question today comes from the line of Robert Gutman from Guggenheim Partners. Your line is now open.

Robert Gutman -- Guggenheim Partners -- Analyst

Hi. Thanks for taking my question. Can you clarify for us, how we should think about the leverage ratio given the impact of the accounting changes to EBITDA and in light of the the quantity of the scale of CapEx spending and the commentary that you are fully funded for 2019?

John Doherty -- Chief Financial Officer

Sure, I'll take that one. Let me give you more of a comprehensive answer. So we ended the year at 4.3 times net leverage. This is among the lowest leverage across the industry. While we don't have a formal target, I would be comfortable with it going a bit higher and obviously it will throughout the year, but I'm comfortable given how the business has been performing, the size and credit quality of our biggest customers and the longer average term of our contracts.

One of the things that is key and we're very confident in is the overall performance of the business. We want to ensure that we stay focused on the opportunities in front of us, continue to grow the top line at a healthy level and drive as much of that through to adjusted EBITDA. If we do, ultimately cash generation will help us to manage to leverage as we move throughout the year. I expect on their current course and speed, we will drew it up to just north of five, but I'm relatively comfortable at that level and you will always look to ways to continue to optimize our capital structure. But as mentioned, as of 2019 -- for everything that we've announced in 2019, we are fully funded.

Robert Gutman -- Guggenheim Partners -- Analyst

Great, thanks. And one other if I can. Can you talk about, I think looking at the recurring revenue growth -- your organic recurring revenue growth, you faced some tough comps because very high numbers in the back half of '17. How should we think about that going forward?

John Doherty -- Chief Financial Officer

I'll also take that one. It's certainly where we're very confident and comfortable with where our growth has been. We've been solidly in the teens each quarter for nearly two years, and while we don't provide quarterly guidance, I think it is appropriate to give you little bit more on 2019, particularly given some of what we've said in the prepared remarks. We expect growth in 2019 to be a bit opposite of 2018. The 2018 first quarter year-over-year, we started about 17%, 18%, and we exited the year at just over 13%.

One of the factors was just -- for the most part, availability of space. Obviously we addressed this with our bond issue in the tap in 2018, and more recently with the increase to our RCF. So for 2019, I expect that we're going to exit the year at a higher year-over-year growth rate than we start, and with earlier in the year and this will give us a really good momentum and a full head of steam as we move into 2020.

Robert Gutman -- Guggenheim Partners -- Analyst

Great. Thank you very much.

Operator

Thank you. Our next question today is from the line of Jonathan Atkin from RBC Capital Markets. Your line is open.

Jonathan Atkin -- RBC Capital Markets -- Analyst

Thank you. So I was interested in the cross connect revenue trends, and maybe talk about just volume trends, pricing trends that might be coming into play in 2019, and the use cases around cross connects that might drive your growth this year and how they might be different if at all versus prior years. And then just a question about the utility prices in Europe, one of your peers mentioned that's higher and I wonder that's a trend that you're seeing as well and how that close into your operating metrics? Thanks.

David Ruberg -- Chief Executive Officer

Hi, Jonathan. I'm going to try and condense the question you asked or the elements of the question on cross connects and handle it in a following fashion. Given our consumer mix and given our application mix and what we're trying to accomplish with these customers on a long-term basis, we believe that our cross connects are appropriately priced at the present time. Do you have anything you want to add on?

Giuliano Di Vitantonio -- Chief Marketing & Strategy Officer

Jonathan -- This is Giuliano. Hi, Jonathan. You also asked about the use cases and I think David hinted that in the prepared remarks. In the past, the use case which is driving cross connect adoption was primarily the global carriers exchanging traffic among themselves. And in the last couple of years, with the roll out of cloud platforms (Technical Difficulty) going to the local ISPs, the local providers or connectivity in the countries and the traffic is originated by the platforms that distribute to the end user. So the use case has significantly shifted in the last couple of years. It speaks to that interplay between the content, the cloud and the connectivity that David referred to in his prepared remarks.

David Ruberg -- Chief Executive Officer

As far as energy prices in the last six months and in 2018 and going forward, although the cost of generating energy has not risen, the implication of what the European Union is trying to do through CO2 certificates has come to play a significant portion -- a significant part and has increased the cost of procuring energy, and you will see that that is part of what is impacted our gross margin in 2018, as well as 2019. So it's the CO2 emission certificates, not the demand and not the cost of generation. Did I answer your question?

Jonathan Atkin -- RBC Capital Markets -- Analyst

Yes. Thanks very much.

Operator

Thank you. Our next question is from Erik Rasmussen from Stifel. Your line is open.

Erik Rasmussen -- Stifel -- Analyst

Yeah, thanks for taking the questions. One, you mentioned on the cross connects and you're starting to see the 10 gig, the 100 gig sort of migration starting that now happened more in Europe. We've obviously seen that in the US market, but what kind of headwind are you expecting in 2019 and how do you see things progressing?

John Doherty -- Chief Financial Officer

Let me just put -- let me give you -- frame it out from a numbers perspective. Cross connects have continued -- revenue is continuing to grow at a rate higher than our overall growth rate. We still expect that to be the case in '19 over '18. So it's still an area of our business that's accretive to our overall growth. The issue is at 6%. I know there is an expectation that that number would move higher and higher in bigger increments. That's just not the case. We are -- it's a little bit of a different way in which it shows up in our revenues, ultimately it's growing, it's accretive and overall on a net basis.

Giuliano Di Vitantonio -- Chief Marketing & Strategy Officer

And Erik, this is Giuliano. From a customer adoption standpoint, the transition to -- from 10 to 100 gig is going to happen in a gradual way. It would be primarily some new applications that will drive that adoption and the roll out of new equipment. So we don't fall over a number of years, and during that period, the volume of traffic is expected to grow really substantially. Some studies indicate 37% CAGR for the growth of the peak traffic, which is how you dimension your network. So we believe that in terms of headwind, we're not going to see any significant impact because of the high volume of traffic which compensate for the fact that we have a higher bandwidth.

Erik Rasmussen -- Stifel -- Analyst

Great, thanks. And then, in terms of, you mentioned this 10 new on-ramps in it's accelerated since August. Can you talk about how many -- what the total is that you have now and can you comment on how you see things -- the impact of this on your overall business, just to give us some context there?

Giuliano Di Vitantonio -- Chief Marketing & Strategy Officer

Yeah, I don't have the total number off the top of my head. I believe it's close to 40, 50, but I would come back to you with a precise number. So in terms of the impact on the business, it clearly drives demand for cloud connect, but also enterprise, it would start with a small deployment just to connect to the cloud, and then the business evolves and the requirements grow, they keep expanding and adding more racks. So it's the catalyst for our new enterprise to come to us and we have a steady trickle of new enterprises come to us, but also provides a foundation for those enterprises to grow.

David Ruberg -- Chief Executive Officer

It is the foundation for us building a community. It's the same way we built this on the international carriers and eventually migrated that concentration to collect the enterprises that wanted to use them and then the ISPs that wanted to do the customer facing. So as we go forward, these on and off ramps, these edge nodes are what drive the stickiness of our communities of interest.

Erik Rasmussen -- Stifel -- Analyst

Great. Thank you.

Operator

And your next question today is from Nate Crossett from Berenberg. Your line is open.

Nate Crossett -- Berenberg -- Analyst

Hi, thank you. I was wondering if you could give us the level of pre-leasing among the expansions. I don't think you guys disclosed that this quarter or last quarter, and if it's not something you want to disclose, maybe can you talk about how the indications are coming along for some of the bigger projects?

David Ruberg -- Chief Executive Officer

Okay. I may get myself in trouble here. We haven't disclosed this for a while and I'll tell you why, I think because the industry focus is too much on this. These numbers have become lumpy. They're really dependent upon the book-to-bill ratio, which never gets factored into them. And given where we are with our customers and their applications, we have most of the customers we want. They're in our communities. They're in our campuses and we have a very good relationship with them and so we have a very good understanding or a very good idea of what the growth rate looks like, because we sell them energy, and they are all very open with us and it makes it very predictable. So rather than giving, the industry has changed over the last couple of years and now that we have them and we have a great relationship with them where actually in many cases doing joint planning in terms of space, land, and things like that. So we have not revealed either bookings or pre-leasing, because I personally believe that the industry is focused on this. All right.

Nate Crossett -- Berenberg -- Analyst

Okay. Yeah, that's fine. And one more if I could. I wanted to get an update on maybe a potential investment grade rating, kind of, in light of the recent Equinix equity deal in conjunction with their investment grade rating the following day. Do you think that the Equinix developments kind of pave the way for you guys to get investment grade sooner, given that you kind of have similar leverage levels and property ownership levels?

John Doherty -- Chief Financial Officer

The short answer is, we certainly have that as a goal, but it's a bit of a medium-term goal. To go through and do a straight comparison to one of our peers that you mentioned. We take a bit longer than we have on this call, but effectively we are comfortable with our leverage and where we are now, we're comfortable with the prospects we have in front of us over time. That's definitely something that we'd like to go after. But it's -- as I said, it's bit more of a medium term goal.

David Ruberg -- Chief Executive Officer

I may puts this in a little bit of context. This is a capital-intensive business. We are highly focused on returns. We try to get the best customers, the best prices at a lowest cost to construction and capital is really important, and so we have been focused for a long time on reducing our cost to debt.

Nate Crossett -- Berenberg -- Analyst

Okay. That's helpful. Thanks.

Operator

Your next question today is from Sami Badri from Credit Suisse. Your line is open.

Sami Badri -- Credit Suisse -- Analyst

Hi, thank you. My question really has to do with something David commented on toward the end of the prepared remarks and has a lot to do with that mix of enterprises and making up about one-third of total revenues in your ecosystem. When do you think there will be an inflection change where maybe that one-third goes up more, say, to net of about 40% of your revenues for our total ecosystem constituents. Can you give us an idea when the European region will start to inflect faster faster? And as this inflection occurs, will this be the engine that drives the interconnection revenue mix higher, just looking at an idea on how to visualize the Company's results over the next two years?

David Ruberg -- Chief Executive Officer

Okay. Sami, as you know, I don't answer modeling question. So this is the $64,000 question. This has changed. We originally thought it would be precipitated by what was coming from the United States, that's not the case. So what we've seen happen is people close to their corporate headquarters of which quite a few here in Europe, began to experiment with it.

The second question that you asked is easier to answer. Yes, this will certainly drive the interconnection business, because most of these applications that will stick with us are communication sensitive, response time sensitive and customer focusing. So I don't expect it to happen, this is just me personally. We're not expecting it to happen for the next couple of years in terms of the inflection point, but we are beginning to see more in Europe than we thought we were going to see. Do you want to add anything to that?

John Doherty -- Chief Financial Officer

Yeah. As we mentioned earlier, Sami, it's more of a gradual adoption at this point. So we are seeing that increase, of course, enterprise is growing as well. So enterprises are going through this migration. It's the migration that takes time, it requires -- it involves transforming their IT organization, their networking infrastructure. So it's something that is happening over a period of time. And so as David mentioned, it's unlikely in the next couple of years we will seen an inflection point, but we will certainly continue to see the growth that we've seen at least in 2018.

Sami Badri -- Credit Suisse -- Analyst

Got it. Thank you for the color on that. And then my next question has to do with the ARPU which connect to EUR411 to EUR414 for the year. Now, as we think about specifically that range, and you commented early on this call that your initial guidance could be concerted relative to the -- in the final year results. Which market do you think will drive positive surprise relative to this EUR411 to EUR414 ARPU?

David Ruberg -- Chief Executive Officer

I'm not sure we heard your question. The lines were garbled, but did you ask what markets do we expect to see pleasant surprises in the ARPU developments? Is that the essence of your question?

Sami Badri -- Credit Suisse -- Analyst

Yeah, that's right.

John Doherty -- Chief Financial Officer

Let me jump in, I guess, maybe it's an interesting question, I appreciate it. But I'm not sure if I would conclude looking at the business that way, because obviously in some markets, when we deploy more capital, more space, there is more opportunity for growth that can ultimately have some impact on that number. So it's a positive surprise in that market. I mean, effectively, what we told you, we expected to be stable. We're really comfortable with that, and I think that's pretty much good for now.

David Ruberg -- Chief Executive Officer

Just in a general observation, we try not to be surprised too much by anything up or down. So maybe there's more color to your question that we can address later, but we are giving you best bet in terms of the aggregate amount over the company, OK.

Sami Badri -- Credit Suisse -- Analyst

Thank you.

Operator

Thank you. And our next question is from Colby Synesael from Cowen & Company. Your line is open.

Michael -- Cowen & Company -- Analyst

Hi, this is Michael on for Colby. First, the implied CapEx per square meter at the midpoint of 2019 guidance is around EUR24,000 versus EUR20,000 in the past two years. Are you seeing an increase in build costs, and if so, what's driving this? And then secondly, we appreciate you don't want to discuss the percentage of space coming online, it's pre-lease, but any color on where you expect utilization rates to be by year-end would be great? Thank you.

David Ruberg -- Chief Executive Officer

Okay. The primary -- we're not seeing an increase in the costs and actually you referenced it per square meter. But part of what's happening is the density is going up per square meter. So it's really on a kilowatt basis, that's one.

Two, most of these that we're acquiring now include the land purchase prices. Over the years, we've started to buy more land, larger land. So, no real increase in the construction cost as a matter of fact, because we can build bigger and build -- and design more consistently on a per unit cost, which we look on a per kilowatt basis is actually coming down. And the second part of his question is, do you ...

John Doherty -- Chief Financial Officer

Utilization rate...

David Ruberg -- Chief Executive Officer

Approximately the same.

John Doherty -- Chief Financial Officer

Yeah.

Michael -- Cowen & Company -- Analyst

Thank you very much.

Operator

Thank you. And your next question is from the line of Tim Horan from Oppenheimer. Your line is open.

Timothy Horan -- Oppenheimer -- Analyst

Thanks guys. Dave, do you think you're gaining share versus your peers and is it kind of a stated goal of yours. And just secondly, do you think CapEx is going to remain fairly elevated for a few years of demand will remain the strong for a few years? Thanks.

David Ruberg -- Chief Executive Officer

Okay. Market share is an interesting thing, it depends upon what markets, sub-market you're going after. I think as Giuliano pointed out, we kind of hinted with the number of network nodes that we're going after. I think we've done a really good job, where we look at the type of business we want, we've certainly maintained market share and we probably added to the market share, OK. We don't base it on square meters, we don't base it on kilowatts, we base it on how we're going to position ourselves for the maximum value long-term. So I think, yes, we have.

And in terms of CapEx, we are very disciplined in how we do it, it is based on the returns. And if the returns continue to be where they are, and we believe they will be, we will find a way to deploy -- acquire and deploy capital to meet that demand and generate the same returns.

Timothy Horan -- Oppenheimer -- Analyst

And on the share gains, do you think it's helping you, that you're more European focused and maybe your cross connect prices are a little lower than peers or anything else that you're doing that's helping gain share?

David Ruberg -- Chief Executive Officer

I think what helps us gain share is the fact that we've had a consistent go-to-market strategy for the last forever number of years and our customers recognize this and it is our customer focus, focus on what's best for the customers, understand what the customers want, try to anticipate what the customers want, enter into a -- everything that we do starts with customer focus that I think is a differentiator.

We certainly didn't have the biggest balance sheet, we didn't have presence in the United States, we weren't there when these cloud guys started, they are all in United States. We had to do something different, because the big guys are indeed in Europe, they are in the United States. It's something we did different, not just our presence that has led us to be successful and I think it goes to what we've said many times. We have a very consistent go-to-market strategy. We try to anticipate where this is rather than fall behind and follow them.

Timothy Horan -- Oppenheimer -- Analyst

Thank you.

Operator

Your next question is from James Breen from William Blair. Your line is open.

Eric -- William Blair -- Analyst

Hi, this is Eric. The first question is about the accounting change. I'm just wondering if you could quantify how much of the 600 basis points margin expansion in 2018 was due to reduced rent expense and how much of that goes to the increased depreciation charge. And then secondly, if you could just talk about the competitive environment, and have you seen any changes over the course of last six months or so? Thank you.

John Doherty -- Chief Financial Officer

Yeah, I'll take the first part and I hand it over to David for the second. So the first part of the 600 basis points, applied across all of our leases, which primarily all of them were related to rent, so well over 90%. And then if you look going forward, it's kind of a modeling question. I'm not going to violate David's principle of answering the modeling question, but effectively, what I would look at is we're somewhere around -- the split would be somewhere around 75% depreciation, 25% interest.

Eric -- William Blair -- Analyst

Okay. Great.

John Doherty -- Chief Financial Officer

By the way, John, you can answer the modeling questions. I'm just not qualified.

David Ruberg -- Chief Executive Officer

Now, I forgot (multiple speakers). I think if you look at -- you don't need to ask me the question about the changing competitive environment, you just need to look at our results and compare it to our competitors' results for the fourth quarter and that speaks a whole lot louder than anything I could say. Okay.

Eric -- William Blair -- Analyst

Okay, thank you.

Operator

And our final question today is from Frank Louthan from Raymond James. Your line is open.

Frank Louthan -- Raymond James -- Analyst

Great. Thank you very much. Talk to us a little bit about capital. Some of your peers of using some joint ventures to raise capital and discuss if you looked at that. And then, what's been the impact of infrastructure funds, I'm looking to back data centers in your markets. Have you seen any pricing impact from that? Thank you.

John Doherty -- Chief Financial Officer

I'll take that one, Frank, and I'm sure David may add some comments. It's no mystery that there is a significant amount of capital available from private sources, the infrastructure funds as you mentioned, but also sovereign wealth funds seeking to access this market. I think one thing to note there is because of how attractive this market is and ultimately steady cash, steady revenue growth, solid returns. And as you know, we've seen a number of these examples in the market, some of our peers have done that.

However, you need to look at what is behind some of this. Some of these initiatives are driven by some of the operators that understandably are seeking to avoid slowing growth rates and diminishing returns. We do not have that problem and these JVs are not without their challenges around asset contribution structure, particularly from a tax perspective, how you split the return. Our focus really needs to continue to stay on executing on the strong organic and consistent margin opportunities that are out in front of us, over the next few years to continue to drive the value for our shareowners.

Now, yeah, we say, some of the private guys are also playing in what I'll call the transactional market, the M&A market, and that's having a little bit of impact on the values of some of these assets, also I think helping a little bit in the public markets as well. From a competitive perspective across Europe, we're really not seeing any major impact whatsoever.

David Ruberg -- Chief Executive Officer

We -- our business is based on value proposition, not necessarily cost proposition. So we -- you see in United States, quite a few new entrants into the wholesale market, because that is for those customers that are getting -- using those services, they want the lowest cost of service. That is not the business that we're in. And as we pointed out, the barriers to entry are substantially more difficult in this colocation business, the returns are different and therefore we do not see the sovereign wealth funds or the infrastructure people entering into our type of business like they might for those that are just real estate oriented.

Frank Louthan -- Raymond James -- Analyst

Great. Thank you much.

Jim Huseby -- Investor Relations

That concludes our fourth quarter earnings conference call. Thank you all for joining us. We expect to see many of you guys out on the road over the next several weeks, and we expect our first quarter results available in early May. Thank you very much, and you may disconnect.

Operator

Thank you. That does conclude the webcast for today. Thank you all for participating. You may now disconnect.

Duration: 63 minutes

Call participants:

Jim Huseby -- Investor Relations

David Ruberg -- Chief Executive Officer

John Doherty -- Chief Financial Officer

Robert Gutman -- Guggenheim Partners -- Analyst

Jonathan Atkin -- RBC Capital Markets -- Analyst

Giuliano Di Vitantonio -- Chief Marketing & Strategy Officer

Erik Rasmussen -- Stifel -- Analyst

Nate Crossett -- Berenberg -- Analyst

Sami Badri -- Credit Suisse -- Analyst

Michael -- Cowen & Company -- Analyst

Timothy Horan -- Oppenheimer -- Analyst

Eric -- William Blair -- Analyst

Frank Louthan -- Raymond James -- Analyst

More INXN analysis

Transcript powered by AlphaStreet

This article is a transcript of this conference call produced for The Motley Fool. While we strive for our Foolish Best, there may be errors, omissions, or inaccuracies in this transcript. As with all our articles, The Motley Fool does not assume any responsibility for your use of this content, and we strongly encourage you to do your own research, including listening to the call yourself and reading the company's SEC filings. Please see our Terms and Conditions for additional details, including our Obligatory Capitalized Disclaimers of Liability.

Cramer's lightning round: Slow and steady wins the race 3 Hours Ago | 04:09

Cramer's lightning round: Slow and steady wins the race 3 Hours Ago | 04:09

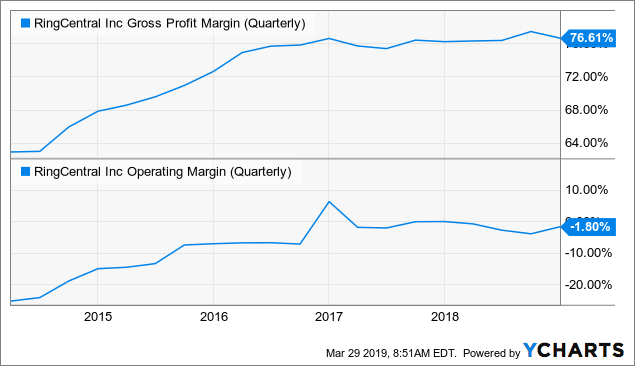

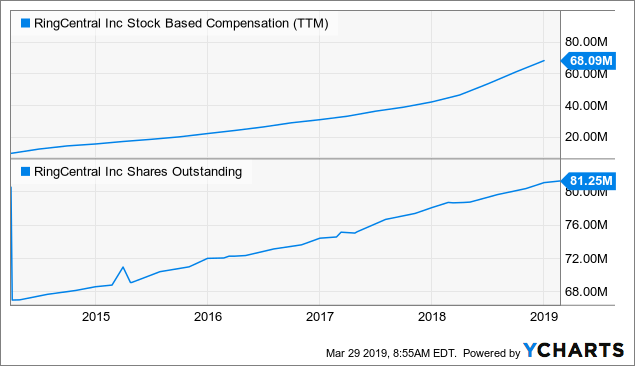

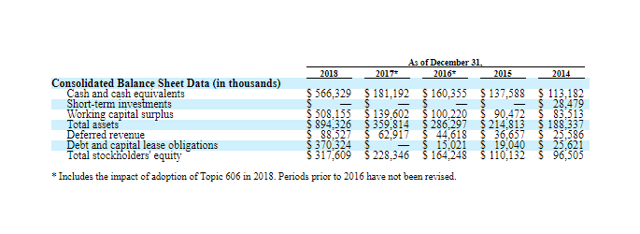

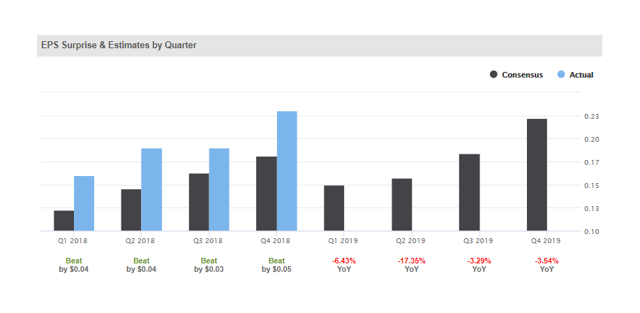

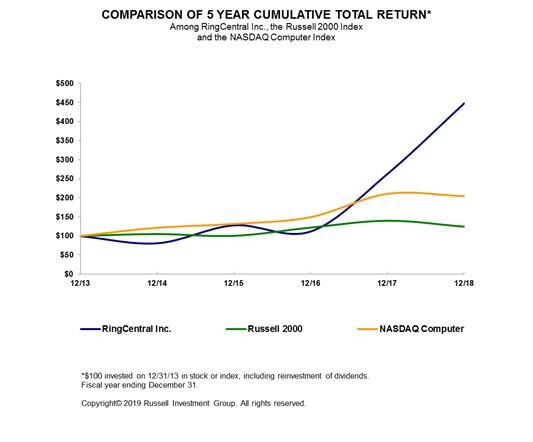

Data by YCharts

Data by YCharts

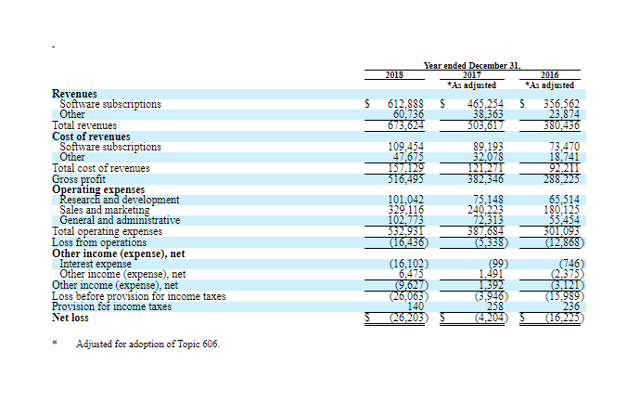

Data by YCharts

Data by YCharts Data by YCharts

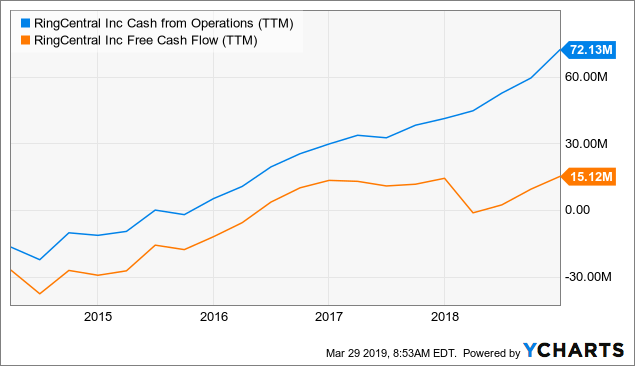

Data by YCharts

Data by YCharts

Data by YCharts

to identify the stocks with the most breakout potential.

to identify the stocks with the most breakout potential.

Equities analysts expect that Hill-Rom Holdings, Inc. (NYSE:HRC) will announce sales of $707.80 million for the current quarter, Zacks Investment Research reports. Four analysts have provided estimates for Hill-Rom’s earnings. The lowest sales estimate is $702.60 million and the highest is $716.20 million. Hill-Rom posted sales of $710.50 million during the same quarter last year, which would indicate a negative year-over-year growth rate of 0.4%. The firm is expected to issue its next quarterly earnings results on Friday, April 26th.

Equities analysts expect that Hill-Rom Holdings, Inc. (NYSE:HRC) will announce sales of $707.80 million for the current quarter, Zacks Investment Research reports. Four analysts have provided estimates for Hill-Rom’s earnings. The lowest sales estimate is $702.60 million and the highest is $716.20 million. Hill-Rom posted sales of $710.50 million during the same quarter last year, which would indicate a negative year-over-year growth rate of 0.4%. The firm is expected to issue its next quarterly earnings results on Friday, April 26th.

Source: Shutterstock

Source: Shutterstock