RingCentral (NYSE:RNG) is the market leader in UCaaS (Unified Communications As a Service), a market which is rapidly growing and shifting to the cloud.

The company continues to beat expectations, and we'll argue below that its growth is set to continue, although not surprisingly, the shares already reflect much of that growth. While we still see gains, it's perhaps best to wait for a dip in the price.

ProductsYou can see the company's products on its website and a little oversight what it does from the company's earnings deck:

RNG's cloud platform is the fastest growing UCaaS platform (according to Synergy) and a market leader, according to Gartner (earnings deck):

The company grows through the following:

A shift to the cloud Competitive wins Channel Ecosystem Expanding features and upsell InternationalThe market is shifting to cloud platform solutions and away from legacy solutions. RingCentral's big contract win from the Columbia University competing against the top legacy solutions providers is simply a sign of the times. From the Q4CC:

We are seeing a dollar is shifting towards cloud communications solutions from legacy vendors in this $50 billion market. This is consistent with the recent report published by Gartner titled Cloud-Based Unified Communications and Contact Center Momentum is refocusing our Magic Quadrant research for 2019. It states that, by 2022, four cloud-based UCaaS licenses will be served for every premises base utilizers, driven by an expanding fleet of capabilities in UCaaS solutions.

Cloud platforms have crucial advantages, such as connections, scalability, expansion and a seamless user experience (for a description of the advantages and the difference with VoIP solutions, see here).

The company made two acquisitions, Connect First and Dimelo, which it used to launch its customer engagement platform RingCentral Engage. Although they don't contribute any significant amount of revenue, they're tuck-in acquisitions acquired for their platform-enhancing capabilities and further boost upsell opportunities.

The company launched other new products like its unified mobile app (Q4CC)...

...with integrated team messaging, voice and media seamlessly combined into a single application.

The channel partners is a somewhat surprising source of growth, given it is now being a $180M business growing at 80% (in Q4 y/y). Also, 70% of the company's seven-figure wins were from channel partners.

Perhaps somewhat counterintuitive, the economics are also favorable (Q4CC):

the cumulative profit dollars for channel are accretive to the business and a higher than direct for three reasons, one, is that the payback is faster, there is no other incremental material sales and marketing dollars you have to spend, and the overall churn is lower in the channel... So and then, again, cherry on top, if the channel does free up extra investment dollars for us to invest those dollars in the direct sales and marketing, which then accelerate the growth.

Management expects this 80% channel growth to continue.

The company has a blossoming ecosystem of app developers and app integrators, as well as a series of business app integrations from well-known providers like Microsoft (NASDAQ:MSFT) and Google (NASDAQ:GOOG) (NASDAQ:GOOGL). From the Q4CC:

The number of registered developers on our platform is now close to 20,000 and we have approximately 2,000 certified app integrations.

The company's international sales are still small (less than 10% of revenue), but they are growing faster than overall sales, and the company is making an effort to increase its international footprint.

RNG is already well established in the UK and Canada, but is now moving to France and Australia, for instance.

Q4 ResultsHere are the highlights from the company's earnings deck:

As you can see, the company had a massive quarter, beating expectations by $8M, of which 40% materialized in the bottom line. Management argues this is an inherent leverage of the SaaS business model, driven by two forces:

Churn, which was down to single digits for the first time in the company's history. Upsell - About 40% of new bookings came from existing customers; clearly, the company's land and expand strategy is working.One should keep in mind that Q4 is a seasonally strong quarter for the company, although this seasonality isn't that strong. EPS beat by $0.05 and came in at $0.23, and revenue grew 34%.

Here is another look (earnings deck):

The company used to do $50M per year in business with AT&T (NYSE:T). It has re-engaged with AT&T late last year, and although management doesn't expect all that much revenue from AT&T in 2019, this has a clear potential for the future.

The company had a very good quarter getting other big customers on board as it raked in eight seven-digit TCV (total contract value) deals in Q4 (one of which was an eight-figure deal, the company's first). For the year, there were eight of these big deals, so all of them barring one arrived in Q4.

GuidanceFrom the earnings deck:

Management argues that the company is well on track to break the $1B revenue in 2020 and that seems a pretty reasonable assumption.

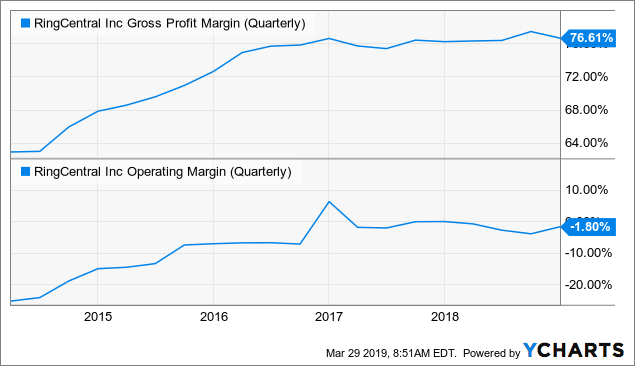

Margins Data by YCharts

Data by YCharts

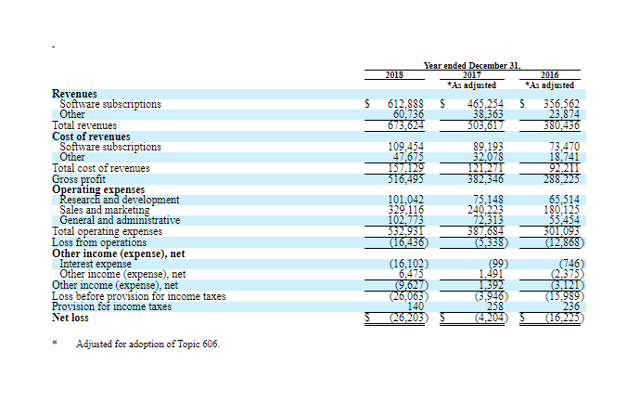

GAAP margins have trended up, although not recently. Here is a more detailed view from the 10-K:

Non-GAAP margins are considerably higher. Here is the difference for Q1:

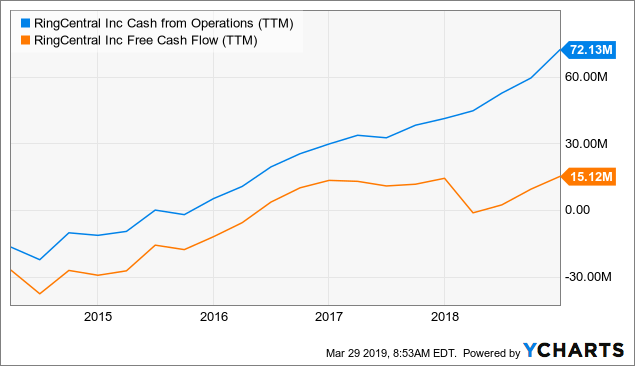

Data by YCharts

Data by YCharts

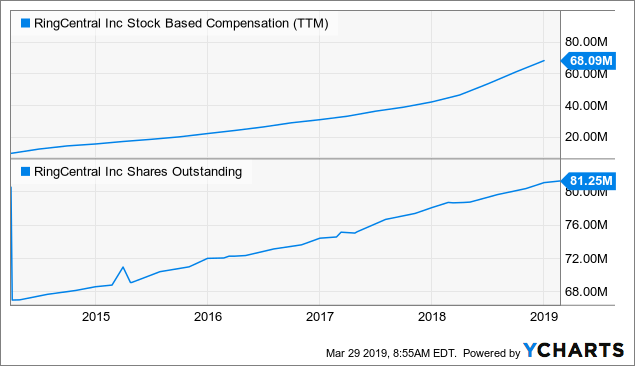

The company's cash flow has steadily improved and now solidly positive, although this is due to share-based compensation, which has also led to a considerable dilution, much of it through non-stop selling from executives (scroll down to the bottom here).

Data by YCharts

Data by YCharts

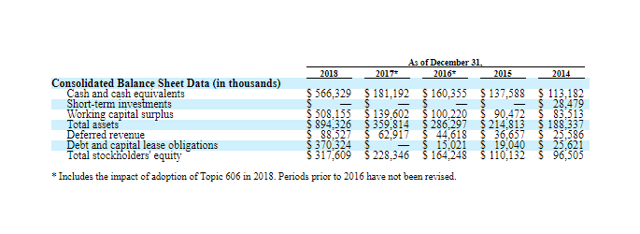

The company's balance sheet is pretty healthy. From the 10-K:

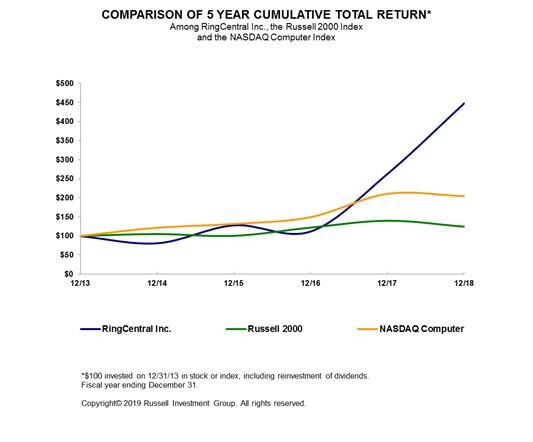

The success of the company hasn't exactly gone unnoticed:

Data by YCharts

Data by YCharts

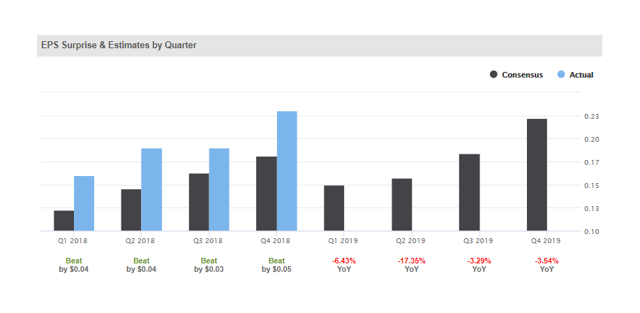

Valuation is fairly steep, although on a forward basis, that comes down to 10x sales. The company's recent earnings considerably beat analyst estimates. From SA:

Analysts expect an EPS (non-GAAP) of $0.71 this year rising to $0.94 next year, but clearly shares are still very expensive on an earnings basis. Given the market recovery and the excellent Q4 results, the stock has been on a tear since late last year:

And there is a little figure in the 10-K, which is quite telling:

RingCentral clearly has the right products and is getting ever bigger clients. We think there is every reason to expect this growth to continue, as the company has a number of cylinders to fire on, and the market is still in the early innings with its shift to the cloud.

But RNG's shares already reflect much of that growth. We don't see room for valuation multiple expansion, and the share count is a bit of a drag on EPS growth.

The next phase will be when operational leverage turns into GAAP profits. The cash flows can be used to buy back shares, and we're not that far off.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment